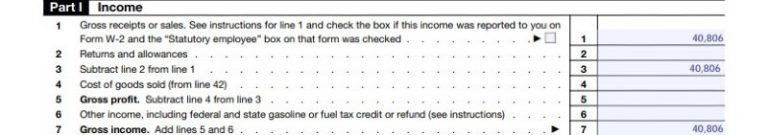

An additional $500 million has been set aside for applicants with 2019 gross receipts of not more than $50,000.00. An additional $4 billion has been set aside for applicants with 2019 gross receipts from $500,001.00 to $1,500,000. Under the RRF, $5 billion has been set aside for applicants with 2019 gross receipts of not more than $500,000.00. During this second period, the SBA will accept applications from all eligible applicants. The second window starts on Day 22 until all funds in the RRF are exhausted. All applicants must self-certify on the application that they meet eligibility requirements for this Priority Period.

SBA MONTHLY GROSS RECEIPTS FREE

Economically disadvantaged individuals are those socially disadvantaged individuals whose ability to compete in the free enterprise system has been impaired due to diminished capital and credit opportunities as compared to others in the same business area who are not socially disadvantaged. Socially disadvantaged individuals are those who have been subjected to racial or ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities. Priority Groups include a small business that is at least 51% owned by one or more individuals who are 1) women, 2) veterans, or 3) socially and economically disadvantaged. The first, “Priority Period”, which is from Day 1 through Day 21 is open to businesses that fall under “Priority Groups”.

SBA MONTHLY GROSS RECEIPTS WINDOWS

There are two application windows under the RRF. In addition to the onsite sales documentation for certain businesses, applicants must provide documentation to verify tax information and gross receipts. For businesses that opened in 2020 or have not yet opened, the applicant’s original business model should have contemplated at least 33% of gross receipts in on-site sales to the public.Īpplicants for the RRF should apply through the RRF portal at or through an SBA-recognized Point of Sale vendor. Licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase productsįor businesses noted above that must have at least 33% of gross receipts from sales to the public, documentation must be submitted with the RRF application evidencing the sales for 2019.

Inns (onsite sales of food and beverage to the public comprise at least 33% of gross receipts).Wineries and distilleries (onsite sales to the public comprise at least 33% of gross receipts).Breweries and/or microbreweries (onsite sales to the public comprise at least 33% of gross receipts).Brewpubs, tasting rooms, taprooms (onsite sales to the public comprise at least 33% of gross receipts).Bakeries (onsite sales to the public comprise at least 33% of gross receipts).Recipients of these funds are not required to repay anything as long as the funds are used for eligible uses no later than March 11, 2023.Įligible businesses under the RRF are businesses that are not permanently closed and have experienced COVID-19 pandemic-related revenue losses including: Eligible businesses may receive funding up to $10 million for lost revenue, but no more than $5 million per physical location, including affiliates, with a minimum of $1,000.00. The RRF was created under the American Rescue Plan Act to provide funding to keep eligible businesses open during the COVID-19 pandemic. The Small Business Administration (“SBA”) has begun accepting applications from eligible businesses under the Restaurant Revitalization Fund Program (“RRF”).

0 kommentar(er)

0 kommentar(er)